Ethics in accounting is not a theory. It is the difference between trust and damage. When you share your financial records, you hand over your plans, risks, and secrets. You expect honesty. You expect care. You expect silence where silence is needed. When an accountant cuts corners or hides the truth, people lose savings. Employees lose jobs. Communities lose faith. This is why strong ethics must guide every choice in an accounting firm. Clear rules, open records, and firm boundaries protect you, your business, and the public. They also protect the small business accountant who wants to do the right thing but faces pressure to bend. This blog explains why ethics in accounting is not optional. It is your first safeguard against fraud, confusion, and fear.

What “ethics” means in an accounting firm

Ethics in accounting means three simple things. Tell the truth. Follow the law. Put the public first.

You trust an accountant with numbers that shape real lives. Paychecks. Rent. College plans. Medical bills. When those numbers are twisted, people get hurt. You might lose your business. Your employees might lose work. Your family might face stress and blame.

Ethical rules in accounting come from law and from shared standards. You can see this in the Sarbanes-Oxley Act guidance from the U.S. Securities and Exchange Commission. That law grew out of past fraud that ruined pensions and savings. The lesson was simple. Accounting firms must act with strong honesty or the damage spreads fast.

Why ethics matter to you and your family

Ethics in accounting might look distant. It is not. It touches daily life in three clear ways.

- Your paycheck depends on honest books

- Your savings and retirement depend on honest reports

- Your local schools and services depend on honest taxes

When a firm keeps clean books, your employer can plan, borrow, and pay you on time. When public companies report honestly, your retirement fund holds real value, not empty promises. When taxes are reported with care, your community has money for roads, safety, and public health.

When ethics fail, the opposite happens. Raises freeze. Jobs vanish. Savings shrink. Local budgets get tight. You feel the shock even if you never met the person who cheated.

Key principles that guide ethical accounting

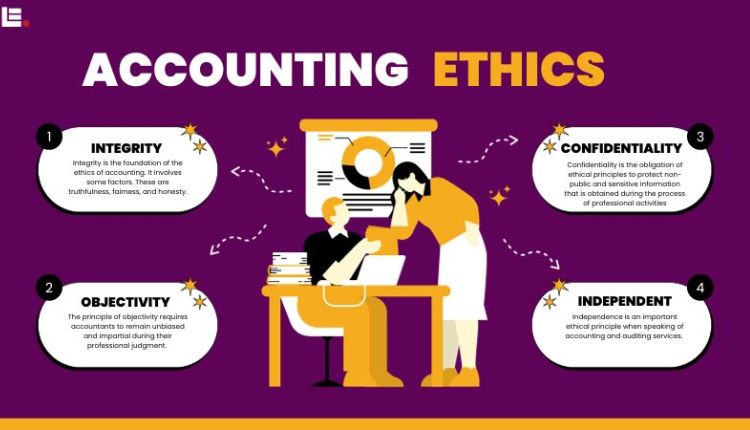

You can look for three core principles in any ethical accounting firm.

- Integrity. The firm tells the truth even when it hurts profits or angers a client.

- Objectivity. The firm does not let gifts, friendships, or fear sway the numbers.

- Confidentiality. The firm protects your private data and shares it only when the law or your consent requires it.

The American Institute of CPAs and many state boards teach these points in their codes. You can also find support in public guidance from the U.S. Government Accountability Office “Yellow Book” on audit standards. That guidance stresses independence, integrity, and care in every audit.

How ethical and unethical firms compare

You can spot patterns that separate ethical firms from those that cut corners. This simple table helps you compare.

| Topic | Ethical accounting firm | Unethical accounting firm

|

|---|---|---|

| Handling of mistakes | Admits errors quickly. Fixes them. Tells you what changed. | Hides errors. Blames others. Alters records without clear notice. |

| Pressure from clients | Refuses to change numbers to please you. Offers legal options instead. | Agrees to “adjust” income or expenses to meet targets or cut taxes. |

| Staff training | Provides clear ethics training. Encourages questions and reports. | Focuses only on speed and billable hours. Treats ethics as an afterthought. |

| Whistleblower support | Has safe ways to report concerns without punishment. | Mocks or punishes staff who raise red flags. |

| Communication with you | Explains choices in plain language. Shares risks and limits. | Uses confusing language. Hides the impact of choices. |

What you should expect from your accounting firm

You have a right to expect three basic protections when you hire an accounting firm.

- Clear contracts that state duties, limits, and fees in writing

- Regular updates that explain what work has been done and what is still open

- Quick answers when you ask about risks, tax laws, or record changes

You should also expect the firm to turn down any request that looks dishonest, even if you push for it. That refusal protects you from audits, fines, and crimes. It might feel hard in the moment. It keeps you safe later.

How firms build a strong ethical culture

Ethical behavior does not grow by chance. Firms must build it on purpose.

Leaders need to set clear rules. They must show in their own work that they follow those rules. They need to support staff who speak up. They must remove staff who cheat. That mix of clarity, example, and action shapes the firm’s culture.

Firms can also use three tools.

- Written codes of conduct that every staff member reads and signs

- Annual ethics training that uses real stories and hard choices

- Independent reviews that check the quality of work and controls

When you see these tools in use, you can feel more secure that your records sit in careful hands.

How you can protect yourself and your business

You are not powerless. You can ask direct questions.

- “What steps do you take to prevent fraud in your own firm?”

- “How do you handle conflicts of interest”

- “What happens if a staff member sees something wrong”

You can check licenses and any public discipline with your state board of accountancy. You can compare firms and walk away from any firm that will not answer your questions.

When you choose an accountant who values ethics, you protect your family, your workers, and your future. You choose truth over fear. You choose calm over chaos. You send a clear message. Your trust is precious, and you expect it to be treated with care.