In today’s fast-paced digital world Payment Gateway, managing contracts effectively is a cornerstone of business success. A robust contract management system can streamline the creation , execution, and tracking of contracts, ensuring efficiency and compliance. One crucial component of a contract management system is the integration of a payment gateway. This enables secure and seamless payment transactions, which are essential for contract-based agreements. Additionally, integrating features such as job scheduling and resource planning and an inventory management system can further enhance the system’s utility and productivity.

This article explores the best payment gateway solutions for contract management systems, their features, and how they can transform your business operations.

What is a Payment Gateway?

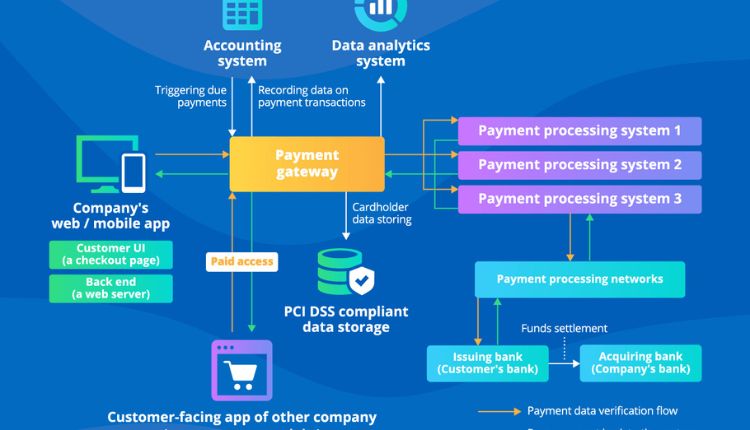

A payment gateway is a technology that enables businesses to accept digital payments securely. It acts as an intermediary between the payer and the payee, ensuring that transactions are authorized, processed, and completed securely. In the context of a contract management system, a payment gateway simplifies the payment process by enabling secure and automated transactions tied directly to contract milestones.

Key Benefits of Integrating a Payment Gateway into a Contract Management System

- Streamlined Payment Processes: Automate payments based on contract terms, milestones, or recurring schedules.

- Enhanced Security: Protect sensitive payment data with encryption and PCI DSS compliance.

- Improved Transparency: Keep all payment-related details linked to specific contracts for easy tracking.

- Faster Payment Cycles: Reduce manual intervention and delays in invoicing and payments.

Top Payment Gateway Solutions for Contract Management Systems

1. PayPal

PayPal is a globally recognized payment gateway offering robust integration options for contract management systems. Its API allows developers to automate payments and link them to contract milestones.

Features:

- Support for multiple currencies and global transactions.

- Advanced fraud protection tools.

- Easy integration with most contract management platforms.

Best For:

Small to medium-sized businesses looking for a reliable and user-friendly payment gateway.

2. Stripe

Stripe is known for its developer-friendly API and advanced customization capabilities. It is ideal for businesses that require flexibility in their payment systems.

Features:

- Support for subscription payments and recurring billing.

- Extensive documentation for seamless integration.

- High-level security measures, including encryption and tokenization.

Best For:

Enterprises seeking a customizable payment gateway for complex contract management needs.

3. Square

Square offers a suite of payment solutions designed for businesses of all sizes. It integrates seamlessly with contract management systems, enabling efficient payment tracking.

Features:

- Transparent pricing with no hidden fees.

- Tools for invoicing and recurring payments.

- Integration options for job scheduling and resource planning.

Best For:

Businesses that need a cost-effective solution with additional tools for resource planning.

4. Authorize.Net

A pioneer in the payment industry, Authorize.Net provides comprehensive payment solutions with a focus on security and reliability.

Features:

- Support for recurring billing and subscription management.

- Robust fraud detection and prevention tools.

- Compatibility with inventory management systems.

Best For:

Businesses that prioritize security and require advanced fraud protection.

5. Adyen

Adyen is a global payment gateway that offers a unified platform for online, in-store, and mobile payments. It integrates well with contract management systems, offering seamless payment experiences.

Features:

- Support for over 250 payment methods and currencies.

- Real-time reporting and analytics for payment tracking.

- Easy integration with inventory management systems.

Best For:

Enterprises managing international contracts with diverse payment requirements.

Enhancing Contract Management Systems with Payment Gateway Integration

A contract management system becomes significantly more powerful when combined with a payment gateway. Here’s how such an integration can benefit your business:

1. Automating Payments Based on Contract Terms

Integrate a payment gateway to automate payments tied to contract milestones, reducing manual errors and ensuring timely transactions.

2. Improving Compliance and Audit Trails

Link payment transactions directly to contract records for complete transparency and easy audits.

3. Reducing Administrative Overhead

Automation reduces the need for manual invoicing and payment follow-ups, freeing up your team for more strategic tasks.

4. Strengthening Security

Modern payment gateways offer advanced security features like tokenization and encryption, ensuring compliance with industry standards.

The Role of Job Scheduling and Resource Planning

While a payment gateway is critical for financial transactions, other features such as job scheduling and resource planning can enhance the functionality of a contract management system.

Why is Job Scheduling Important?

For contracts involving services, such as maintenance or construction, job scheduling ensures that tasks are assigned and completed on time. Payment can be tied to job completion milestones, creating a seamless workflow.

How Resource Planning Enhances Efficiency

By integrating resource planning into your contract management system, you can allocate resources (e.g., personnel, equipment) more effectively. This prevents resource conflicts and ensures smooth execution of contract terms.

Key Benefits of Integration:

- Better tracking of task progress and payment status.

- Improved coordination between teams.

- Enhanced reporting and analytics for contract performance.

The Role of an Inventory Management System

For businesses dealing with physical goods or equipment, an inventory management system integrated with contract management software and a payment gateway can drive operational efficiency.

How Inventory Management Fits In

- Tracking Contract-Specific Inventory: Link inventory usage to specific contracts for accurate billing.

- Automating Replenishment: Set triggers for inventory replenishment based on contract needs.

- Integrating Payments: Charge for inventory usage directly through the integrated payment gateway.

Benefits:

- Avoid stockouts or overstocking.

- Streamline operations by linking inventory, payments, and contracts.

- Improve financial planning with accurate inventory-related expense tracking.

How to Choose the Right Payment Gateway for Your Contract Management System

Selecting the ideal payment gateway involves evaluating your business needs and the features offered by different providers. Consider the following factors:

1. Compatibility with Existing Systems

Ensure the payment gateway integrates seamlessly with your contract management software and any associated systems like job scheduling and resource planning or inventory management systems.

2. Security Features

Choose a provider that offers robust security features, including PCI DSS compliance, encryption, and fraud detection.

3. Support for Multiple Payment Methods

Ensure the gateway supports various payment methods, including credit/debit cards, ACH transfers, and digital wallets.

4. Scalability

Select a payment gateway that can handle increased transaction volumes as your business grows.

5. Transparent Pricing

Compare transaction fees, setup costs, and maintenance charges to find a cost-effective solution.

Future Trends in Payment Gateway Solutions for Contract Management

As technology evolves, payment gateway solutions are becoming more advanced. Here are some emerging trends:

1. AI-Driven Payment Processing

Artificial intelligence is being used to detect fraudulent transactions, predict payment trends, and enhance the user experience.

2. Blockchain Technology

Blockchain can provide secure and transparent payment processes, particularly for high-value contracts.

3. Mobile Payments

With the increasing use of smartphones, mobile-friendly payment gateways are becoming essential.

4. Real-Time Payments

Real-time payment solutions reduce delays and improve cash flow, making them a valuable addition to contract management systems.

Case Studies: Successful Integration of Payment Gateways in Contract Management

Case Study 1: Streamlining Payments for a Construction Firm

A construction company integrated Stripe with its contract management system to automate milestone payments. By linking payments to job scheduling, the firm improved cash flow and reduced administrative tasks.

Case Study 2: Enhancing Inventory Management for a Rental Business

A rental business incorporated Authorize.Net into its system, enabling real-time inventory tracking and automated invoicing. This integration reduced errors and improved customer satisfaction.

Conclusion

Integrating a payment gateway with a contract management system is essential for modern businesses seeking efficiency and accuracy. By incorporating features like job scheduling and resource planning and an inventory management system, you can create a comprehensive solution that meets diverse operational needs.

Whether you’re managing simple contracts or complex agreements, choosing the right payment gateway can transform your processes, enhance security, and improve the overall user experience. Evaluate your options carefully and invest in a solution that aligns with your business goals.