Payment gateways are the backbone of online transactions, facilitating seamless payments for businesses and customers. As e-commerce grows, integrating a secure and efficient payment gateway becomes critical to ensure a smooth user experience and build trust. However, the complexity of these systems demands rigorous testing to identify and fix issues that could disrupt transactions. This article takes a deep dive into payment gateway testing solutions, its importance, and the processes involved to ensure that payment systems work flawlessly across devices and locations.

What Is Payment Gateway Testing?

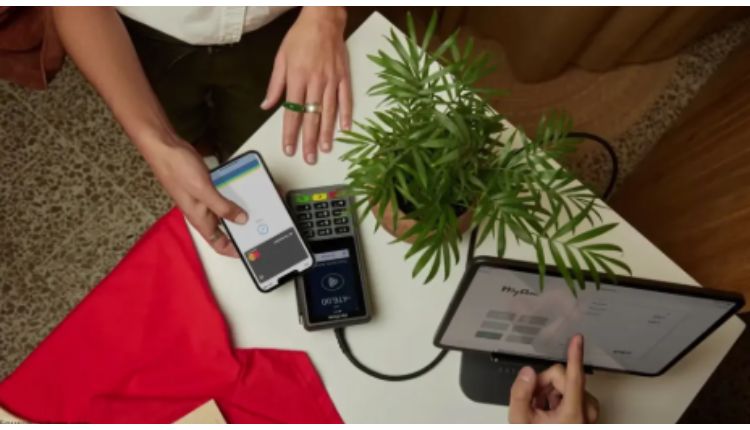

A payment gateway acts as a bridge between customers, merchants, and financial institutions, ensuring that payments are processed securely. It involves multiple steps, including transaction authorization, data encryption, and fund transfer.

Role of Testing in Payment Systems

Payment gateway testing verifies the reliability, security, and performance of the payment process. This involves testing various scenarios, devices, and geolocations to ensure that the system handles all types of transactions efficiently.

Why Is Payment Gateway Testing Critical?

Failures in payment processing can frustrate customers, leading to lost sales and damage to the brand’s reputation. Merchants typically face a number of payment challenges such as gateway integration, regulatory compliance and cross-border transaction complexities. Professional testing ensures that transactions go through smoothly, even during high traffic or across varying conditions.

Ensuring Security

Payment gateways handle sensitive customer information like credit card details. Testing ensures robust encryption, compliance with PCI-DSS standards, and protection against fraud.

Key Aspects of Payment Gateway Testing

This involves checking if the gateway operates as expected, including successful payments, failed transactions, refunds, and cancellations. Functional testing ensures that every user action produces the desired outcome.

Compatibility Testing

Payment systems must work flawlessly across a variety of devices, browsers, and operating systems. Compatibility testing identifies and resolves any issues that may arise in these diverse environments.

Common Payment Issues Addressed by Testing

Different browsers and devices interpret payment gateway scripts differently. Testing ensures a consistent experience on desktops, tablets, and smartphones, regardless of the browser.

Geolocation-Specific Challenges

Payment behavior can vary based on the user’s location due to currency differences, language settings, or regional compliance requirements. Testing ensures smooth transactions worldwide.

Steps in Payment Gateway Testing

- Test Environment Setup

Set up a test environment that mimics the live setup, including the integration of APIs, merchant accounts, and test payment details.

- Test Case Preparation

Develop detailed test cases covering various scenarios like card payments, net banking, UPI, and wallet payments. Include cases for successful transactions, timeouts, and errors.

- Execute Tests

Run the test cases across different devices, browsers, and locations. Test both manual and automated processes for thorough validation.

- Validate Security

Conduct penetration testing to identify vulnerabilities in the gateway. Verify compliance with data protection regulations like GDPR and PCI-DSS.

- Analyze Results and Fix Issues

Analyze test results to identify bottlenecks and issues. Collaborate with developers to fix these problems before moving to production.

Automation in Payment Gateway Testing

Manual testing can be time-consuming, especially for repetitive scenarios. Automation speeds up the testing process and ensures higher accuracy in identifying issues. Popular tools like Selenium, TestNG, and Postman help automate various aspects of payment testing, from functional tests to API validations.

Challenges in Payment Gateway Testing

Payment gateways frequently update their APIs. Testers need to adapt to these changes quickly to ensure compatibility. It can be challenging to replicate all real-world conditions, like different time zones, slow networks, or fluctuating currencies.

Ensuring compliance with regional and global regulations, such as PCI-DSS or PSD2, requires constant updates and validations.

Best Practices for Payment Gateway Testing

- Thorough Documentation: Keep detailed records of all test cases, scenarios, and results for future reference.

- End-to-End Testing: Test the entire transaction process, from payment initiation to fund settlement.

- Real-World Simulations: Use test cards and sandbox environments to mimic real-life user scenarios.

- Regular Updates: Continuously update test cases and tools to adapt to changes in APIs or regulations.

- Collaboration: Work closely with developers, business analysts, and stakeholders to ensure comprehensive testing.

The Bottom Lines

Payment gateway testing is an essential part of ensuring seamless and secure online transactions. By addressing potential issues related to functionality, compatibility, and security, businesses can provide a reliable payment experience across devices and locations. Leveraging both manual and automated testing methods, along with adhering to best practices, ensures a robust payment system that meets user expectations and builds trust. In an increasingly digital world, thorough testing of payment gateways is not just a technical necessity but a cornerstone of business success.