Key Takeaways

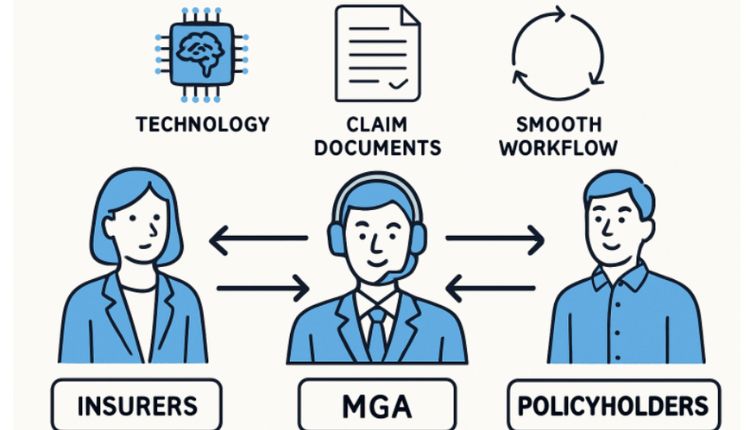

- MGAs bridge the gap between insurers and policyholders, driving efficiency in claims processing while enhancing the customer experience.

- The adoption of AI, automation, and digital platforms is enhancing claims accuracy and speed for MGAs.

- Collaboration and communication with carriers are essential to efficient and compliant claims management.

Managing General Agents (MGAs) serve as catalysts for operational improvement within the insurance sector, connecting insurers with policyholders and assuming critical processes such as claims management. Their specialized expertise enables insurance carriers to be more agile, competitive, and focused on delivering exceptional customer experiences. For those looking to understand what defines an MGA insurance company and its growing influence, it’s essential to explore its impact on streamlining claims processing and optimizing outcomes for all stakeholders involved.

As technology rapidly evolves and customer expectations rise, MGAs are leveraging cutting-edge tools and robust partner relationships to set new standards for claims efficiency. This transformation benefits not only insurers but also brokers, policyholders, and the broader industry.

The Role of MGAs in Claims Processing

MGAs, empowered by insurers to underwrite policies, handle claims, and provide specialized services, have become pivotal intermediaries in the insurance supply chain. This delegation enables insurers to focus on their core products and risk portfolios, trusting MGAs to deliver prompt and accurate claims settlements that ensure satisfied and loyal policyholders. The flexibility of an MGA allows them to meet unique market needs, create tailored coverage options, and drive operational efficiencies for their carrier partners.

The expansive duties of MGAs in claims extend to assessing claim validity, liaising with brokers, facilitating payments, and resolving disputes—tasks that require in-depth expertise and responsive service. As MGAs continue to assume a larger share of the claims process, their ability to resolve cases efficiently has a substantial effect on the reputation and profitability of both MGAs and their insurer partners.

Embracing Technological Innovations

MGAs at the forefront of innovation are leveraging an array of digital solutions to streamline claims management. New technologies are enabling MGAs not only to handle complex volumes of data but also to anticipate industry trends and customer needs. This digital transformation includes:

- AI Adoption: Artificial intelligence (AI) is revolutionizing claims adjudication by analyzing historical claim data, identifying fraud indicators, and swiftly determining payouts for straightforward cases. AI’s power to uncover patterns in loss histories or flag anomalous claims helps MGAs achieve both speed and accuracy.

- Automation: The automation of repetitive tasks—like initial claims intake, document extraction from submissions, and routine communications—reduces administrative burdens and expedites case resolution, freeing up claims handlers for cases that require more nuanced judgment and interaction.

- Digital Platforms: Modern MGAs now deploy customer-facing digital portals where policyholders can submit claims, track status updates, and communicate directly with claims teams 24/7. These interfaces improve transparency and foster trust.

Addressing Challenges in Claims Management

While technology has improved many aspects of claims administration, MGAs continue to face several challenges. The complex nature of insurance claims—often involving multiple parties, intricate documentation, and nuanced investigations—can slow even the most efficient process.

- Complex Processes: Navigating the diverse elements of claims, from verification to settlement, often introduces inefficiencies without strong process controls and smart delegation.

- Data Quality: Inaccurate or incomplete data remains a leading source of claims delays and disputes. Robust data validation and integration are crucial for minimizing complications.

- Regulatory Compliance: MGAs must continually update their practices to stay in compliance with evolving regulations, including data protection laws and consumer rights statutes.

Leading MGAs are taking action to overcome these obstacles by implementing comprehensive staff training, establishing audit trails for compliance, and leveraging analytics to identify pain points and areas for process improvement.

Enhancing Collaboration with Carriers

Seamless collaboration between MGAs and carriers is fundamental to claims success. Regular dialogue, shared data access, and integrated workflows enable MGAs and insurers to resolve issues quickly, implement new technologies, and adapt to shifting market demands. Carriers rely on MGAs’ market specialization and agility, while MGAs count on carriers’ capacity and regulatory infrastructure. Industry best practices include the use of co-developed protocols, ongoing joint reviews of claims handling quality, and shared commitment to customer-centric outcomes. Employing integrated platforms for document management and case tracking further strengthens these relationships.

Establishing Clear Communication

By defining expectations, response timeframes, and escalation procedures upfront, MGAs and carriers can prevent misunderstandings and accelerate claims resolutions. Forming cross-functional teams that bring together underwriters, claims professionals, and compliance experts ensures that all facets of the claims process are aligned.

Real-Life Example: AI in Claims Processing

One notable case involved an MGA that implemented an AI-driven claims triage system. By analyzing thousands of prior claims, the AI categorized new submissions by complexity and urgency. Straightforward claims were processed automatically, slashing average resolution time by 40% without compromising accuracy. More complex or potentially fraudulent claims were escalated to senior adjusters for thorough review, which further protected the carrier from loss leakage and reputational damage. Such technological integration not only reduced operational costs but also led to a rise in customer satisfaction scores, thanks to shorter wait times and more transparent communication throughout the claims journey.

Future Outlook

MGAs are poised to redefine claims management as emerging technologies such as machine learning, blockchain, and predictive analytics mature. Their unique role allows them to serve as innovation incubators for the insurance sector, piloting tools that larger carriers can later adopt. By committing to workforce development, transparent partnerships, and a customer-focused ethos, MGAs will remain integral to efficient, competitive, and resilient insurance ecosystems.

Conclusion

MGAs stand at the vanguard of improvement within claims processing, harnessing technology and dynamic collaborations to solve traditional inefficiencies and deliver high-value services to insurer partners and policyholders. Continued investment in both innovation and relationships will ensure that MGAs are equipped to drive progress in claims management for years to come.